FIRE in Singapore: Your Complete Guide to Financial Independence & Early Retirement (2026)

Discover how to achieve Financial Independence and Retire Early (FIRE) in Singapore. From simple concepts for beginners to advanced CPF strategies, learn the different FIRE types, calculate your FIRE number, and build your path to freedom with Singapore-specific insights.

Imagine waking up tomorrow and never having to work for money again. Not because you won the lottery, but because your money works harder for you than you ever worked for it. This isn't a fantasy—it's FIRE: Financial Independence, Retire Early.

In Singapore, a growing number of people are achieving financial freedom in their 30s and 40s, escaping the corporate grind to live life on their own terms. Whether you're a child learning about money, a young professional starting your career, or approaching retirement, this guide explains FIRE in a way that speaks to you.

Ready to discover how you can join the FIRE movement? Let's start your journey to financial independence.

What is FIRE? Understanding Financial Independence for Every Age

FIRE stands for Financial Independence, Retire Early. It's a movement and lifestyle focused on aggressive saving and investing to achieve financial freedom far earlier than traditional retirement age. But what does this really mean? Let's break it down for everyone, from age 5 to 65.

Level 1: The Magic Piggy Bank (Ages 5-12)

Imagine you have a very special piggy bank. Unlike regular piggy banks that just hold your money, this magical one is special. Every night while you sleep, this piggy bank creates new coins and adds them to itself!

At first, you have to do chores to earn coins and put them in. But as you keep adding more coins, something amazing happens—the piggy bank starts making so many new coins on its own that it gives you coins every day. Eventually, it gives you enough coins to buy all your toys, food, and everything you need without you having to do any more chores!

That's FIRE in the simplest form: building a money machine that takes care of you forever.

Level 2: The Freedom Formula (Ages 13-25)

Now that you're older, let's talk numbers. FIRE is about buying your freedom from having to work. Instead of working until you're 65, you save and invest aggressively now so you can quit your job in your 30s or 40s.

The Math Behind FIRE

The basic formula is surprisingly simple:

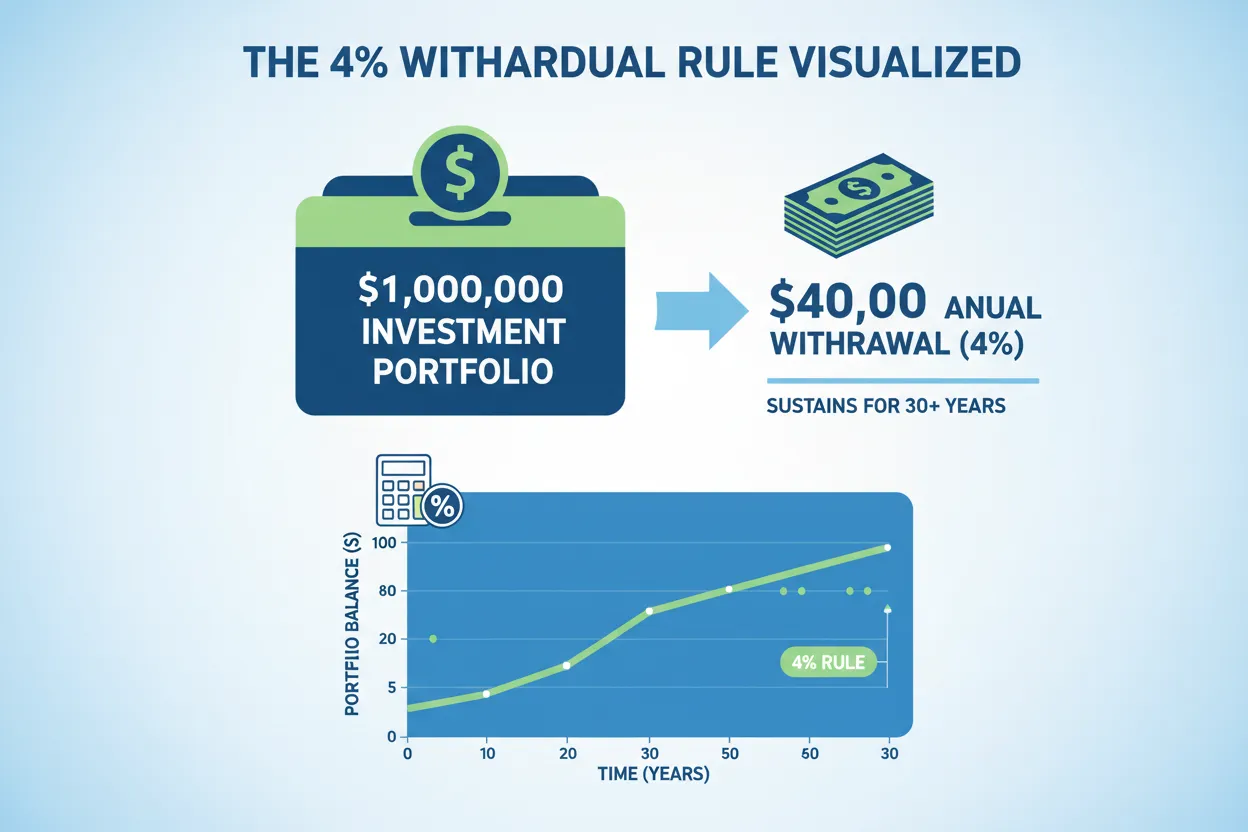

- The 25x Rule: You need to save roughly 25 times your annual expenses

- Example: If you spend $40,000 a year, you need $1 million invested ($40,000 × 25 = $1,000,000)

- The 4% Rule: Once you hit your target, you withdraw 4% per year, and historically, your money lasts 30+ years

The 4% Rule Origin

The 4% withdrawal rule originated from William Bengen's 1994 research and the Trinity Study, showing that a 4% annual withdrawal rate (adjusted for inflation) has historically allowed portfolios to last 30 years or more.

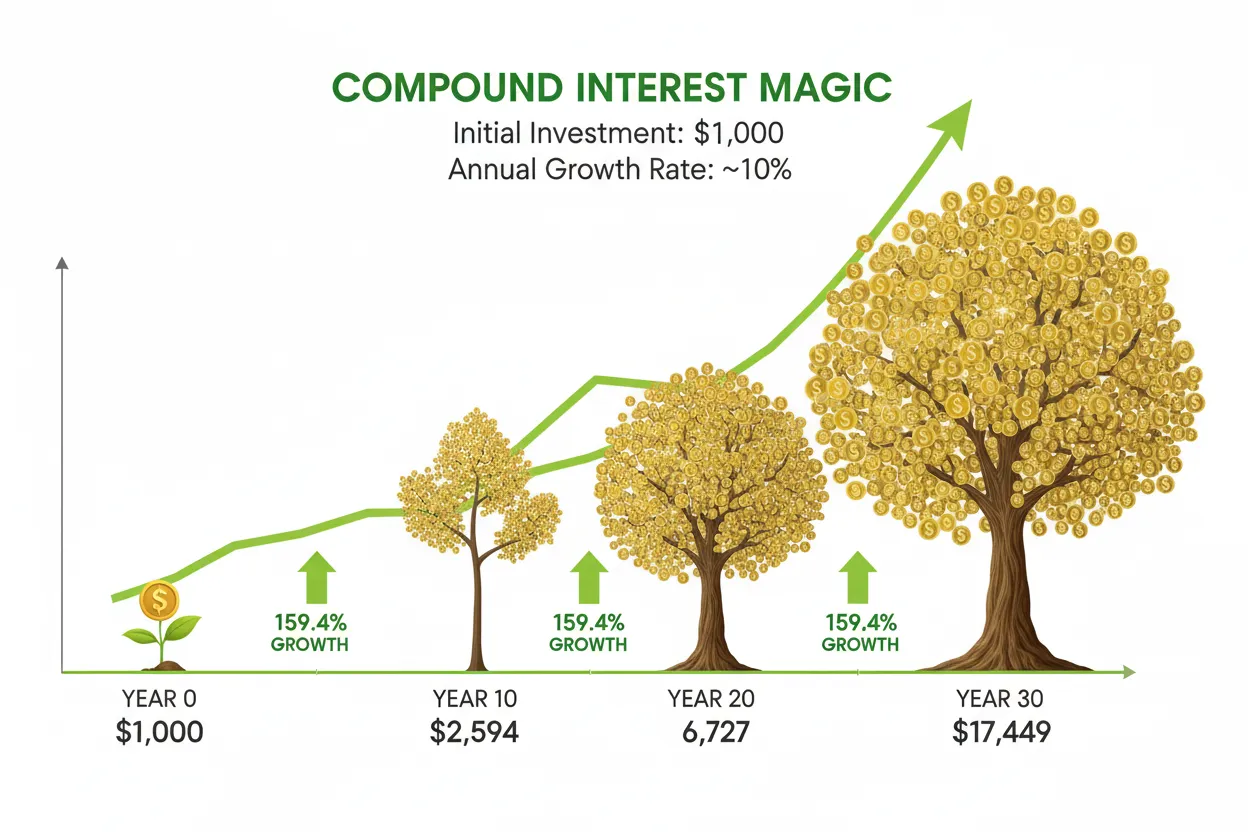

The Magic of Compound Interest

Here's where it gets exciting. When you invest $1,000 and it earns 10% returns:

- Year 1: You have $1,100

- Year 2: You earn interest on $1,100 = $1,210

- Year 10: $2,594

- Year 20: $6,727

- Year 30: $17,449

Your money literally makes more money than you do at your job. This is compound interest—Albert Einstein allegedly called it "the eighth wonder of the world."

Level 3: Choose Your FIRE Adventure (Ages 26-40)

FIRE isn't one-size-fits-all. In Singapore's high cost-of-living environment, you must choose your strategy carefully. Here are the main "flavors" of FIRE:

1. Lean FIRE: The Minimalist Path

Who it's for: Extreme savers who value freedom over luxury.

Annual Budget: Less than $40,000/year

Lifestyle:

- Living in a paid-off 2-3 room HDB flat

- Eating primarily at hawker centers ($5-8 per meal)

- Using public transport exclusively

- Minimal travel (budget options only)

- Free or low-cost entertainment

FIRE Number: $1 million (using 3% withdrawal rate for safety)

Real Example: Mr. J from Singapore set a FIRE goal of $2.16 million and automatically transfers 65% of his salary into investments every month, demonstrating the extreme savings discipline of the FIRE movement.

2. Traditional FIRE: The Comfortable Middle

Who it's for: Those wanting balance between frugality and comfort.

Annual Budget: $40,000 - $80,000/year

Lifestyle:

- 3-4 room HDB or older condo

- Mix of hawker food and occasional dining out

- Annual budget travel (1-2 trips)

- Moderate hobbies and entertainment

- Public transport with occasional Grab rides

FIRE Number: $1.5 - $2 million

3. Chubby FIRE: The Comfortable Upgrade

Who it's for: High earners who want a comfortable retirement.

Annual Budget: $80,000 - $150,000/year

Lifestyle:

- Modern condo or larger HDB

- Regular restaurant dining

- Multiple annual holidays (business class occasionally)

- Car ownership possible

- Premium hobbies and activities

FIRE Number: $2.5 - $4 million

4. Fat FIRE: The Luxury Route

Who it's for: Ultra-high earners maintaining luxurious lifestyles.

Annual Budget: Over $150,000/year

Lifestyle:

- Landed property or premium condo

- Fine dining regularly

- Business class travel, multiple international trips

- Premium cars, helper support

- Luxury hobbies and experiences

FIRE Number: $5+ million

5. Coast FIRE: The Front-Loaded Strategy

Who it's for: Young professionals in their 20s-30s who want to ease up later.

How it works: You invest aggressively early until your portfolio is large enough that compound interest alone will grow it to your retirement target by age 65—without any additional contributions.

The Magic: Once you reach your "Coast Number," you can stop contributing to investments entirely. Work just enough to cover your current living expenses, pursuing passion projects or lower-stress jobs.

Example: A 25-year-old who invests $200,000 can "coast" to $1 million by age 65 with 5% returns, without adding another dollar.

6. Barista FIRE: The Hybrid Approach

Who it's for: People who want to escape corporate stress but don't mind working.

How it works: Save enough to cover essential bills from investments, then quit your high-stress corporate job to work part-time (like a barista, hence the name) to cover daily expenses.

Benefits: Prevents burnout, maintains social connections, provides healthcare benefits (in some countries), and reduces pressure on your portfolio.

Singapore Adaptation: Work freelance, consulting, or passion projects 2-3 days a week while your investments grow.

Level 4: The Singapore Advantage - CPF Integration & Advanced Strategies (Ages 41+)

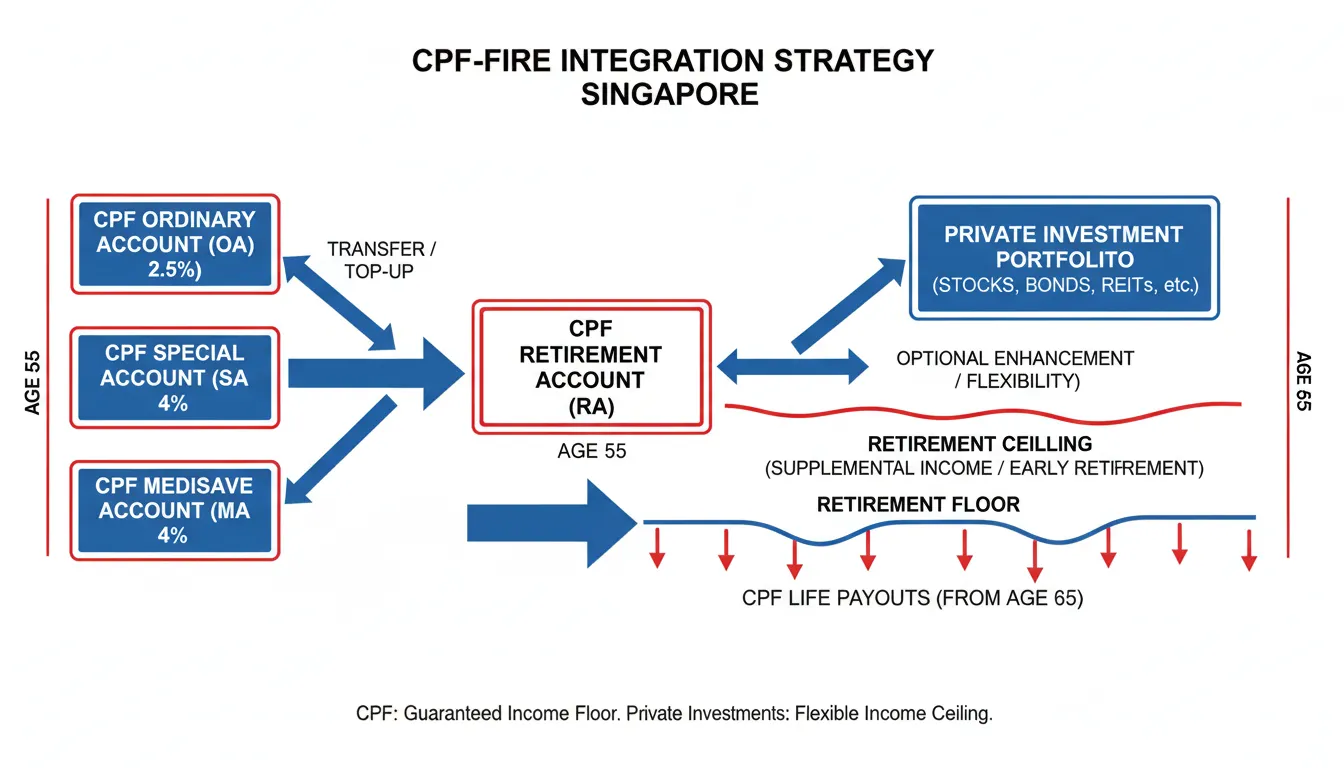

Achieving FIRE in Singapore is different from Western models because we have a unique advantage: the Central Provident Fund (CPF). Smart FIRE planners integrate CPF into their strategy to reduce cash requirements and mitigate risks.

The CPF "Safety Net" Strategy

Instead of relying solely on the 4% rule (which assumes a 30-year horizon), Singaporean FIRE practitioners use a hybrid approach:

- CPF LIFE as the Floor: At age 65, CPF LIFE provides guaranteed monthly payouts for life, covering your "survival" expenses (utilities, basic food)

- Private Portfolio as the Ceiling: Your private investments (stocks, ETFs) cover discretionary spending (travel, hobbies, dining)

- Lower Risk Tolerance: Because CPF LIFE guarantees your basics, you can take higher risks or use variable withdrawal rates with your private portfolio

Understanding the Age 55 Transformation

A critical juncture in Singapore retirement planning occurs at age 55, when your CPF accounts undergo a fundamental transformation:

- Retirement Account (RA) Creation: CPF Board establishes your RA

- Special Account Closes: Your entire SA balance transfers to RA (up to Full Retirement Sum)

- OA Top-up: If SA is insufficient, funds are drawn from your Ordinary Account

- Liquidity Release: Any remaining balances in OA after RA is funded become withdrawable in cash—providing a vital liquidity bridge for early retirees

- Future Contributions Rerouted: What previously went to SA now goes to RA

The Full Retirement Sum (FRS) for 2026 is projected at $220,400, and reaching this amount ensures maximum CPF LIFE payouts.

The 55 Liquidity Bridge

Many FIRE planners time their retirement around age 55 because excess CPF OA funds become accessible, providing a cash cushion to supplement private investments until CPF LIFE begins at 65.

CPF LIFE Payout Tiers

Your monthly CPF LIFE income depends on how much you set aside in your RA:

| Tier | RA Balance at Age 55 | Monthly Payout (from Age 65) |

|---|---|---|

| Basic Retirement Sum (BRS) | $83,000 | $720 - $770 |

| Full Retirement Sum (FRS) | $166,000 | $1,320 - $1,410 |

| Enhanced Retirement Sum (ERS) | $249,000 | $1,910 - $2,060 |

For FIRE practitioners, even the Basic Retirement Sum provides a $720-770/month floor, significantly reducing the private portfolio needed for a comfortable retirement.

Supplementary Retirement Scheme (SRS): Tax Arbitrage for FIRE

The SRS is a powerful but often underutilized tool for accelerating FIRE:

How It Works:

- Every dollar contributed to SRS reduces your taxable income dollar-for-dollar

- Annual cap: $15,300 for Singaporeans/PRs, $35,700 for foreigners

- Withdrawals after statutory retirement age (63) get a 50% tax concession

- Funds must be withdrawn over a 10-year period to maximize tax benefits

The Tax Magic:

A high-income earner in the 22% tax bracket who contributes $15,300 saves $3,366 in taxes immediately. Reinvested over 30 years at 5% returns, these tax savings alone can contribute an additional $1 million to your FIRE fund.

Optimal Withdrawal Strategy:

| Strategy | Annual Withdrawal | Taxable Amount (50%) | Tax Payable |

|---|---|---|---|

| Lump Sum ($400k) | $400,000 | $200,000 | ~$5,650 |

| 10-Year Spread | $40,000 | $20,000 | $0 |

By spreading withdrawals over 10 years at $40,000/year, you utilize Singapore's first $20,000 tax-free threshold, resulting in zero tax on your SRS retirement income.

Managing Singapore's Medical Inflation: The Hidden FIRE Killer

Standard FIRE calculators assume 2-3% inflation. However, medical inflation in Singapore is projected at 16.9% for 2026—nearly quintuple the general inflation rate.

The Risk: If your medical costs grow at 17% annually while your withdrawal rate only adjusts for 2% inflation, your portfolio could be depleted decades earlier than planned.

Mitigation Strategies:

- Buffer Your FIRE Number: Add 20-30% specifically for healthcare inflation

- Maximize MediSave: Contributions above the Basic Healthcare Sum ($79,000 for 2026) overflow to RA/SA, earning 4% interest

- Private Health Insurance: Lock in comprehensive coverage while young and healthy

- Variable Withdrawal Rates: Use conservative 3-3.25% SWR for medical expenses, higher rates for discretionary spending

Medical Inflation Alert

Singapore's medical cost increases are projected to persist into 2026 and beyond, driven by an aging population (77% of insurers cite this), expensive new technologies, and pharmaceutical advances. Plan accordingly.

HDB Lease Buyback Scheme: Unlocking Home Equity

For those who are "asset-rich but cash-poor," the HDB Lease Buyback Scheme (LBS) provides a way to monetize your home without moving:

How It Works:

- Age requirement: 65+

- Sell the tail-end of your HDB lease back to HDB while retaining a 15-35 year lease

- Proceeds first top up your RA to FRS, increasing CPF LIFE payouts

- Excess cash provided as bonus (up to $100,000 cap)

| Flat Type | Cash Bonus |

|---|---|

| 3-room or smaller | Up to $30,000 |

| 4-room | Up to $15,000 |

| 5-room or bigger | Up to $7,500 |

This scheme effectively converts your home into a lifelong income stream via CPF LIFE while allowing you to age in place—perfect for retirees who prioritize stability over leaving an inheritance.

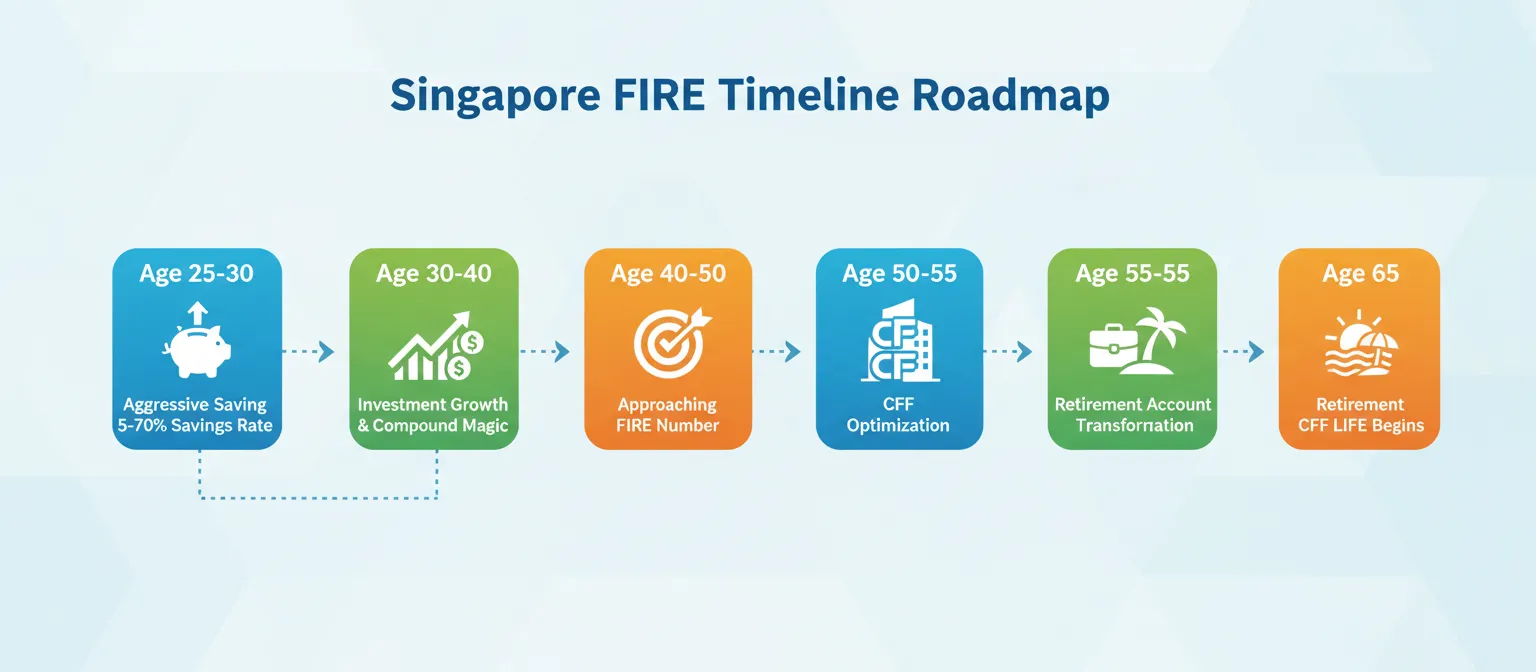

Your FIRE Roadmap: Step-by-Step Action Plan

Ready to start your FIRE journey? Follow this proven roadmap:

Step 1: Calculate Your FIRE Number

Use the formula: FIRE Number = Annual Expenses × 25

For Singapore, adjust based on your FIRE type:

- Lean FIRE: $40,000 × 30 = $1.2M (using 3.3% SWR for safety)

- Traditional FIRE: $60,000 × 28 = $1.68M (3.5% SWR)

- Chubby FIRE: $120,000 × 27 = $3.24M (3.7% SWR)

- Fat FIRE: $200,000 × 25 = $5M (4% SWR)

Note: Singapore FIRE experts recommend 3-3.5% SWR (28x-33x expenses) instead of the American 4% rule due to longer retirement horizons and higher medical inflation.

Step 2: Track Your Current Spending

You can't calculate your FIRE number without knowing your expenses. Track every dollar for 3 months:

- Housing (mortgage/rent, utilities, property tax)

- Food (groceries, dining out, hawker)

- Transport (MRT, car expenses, Grab)

- Insurance (health, life, property)

- Healthcare (medical, dental, prescriptions)

- Entertainment & hobbies

- Travel

- Miscellaneous

Multiply your monthly average by 12, then by 25-33 to get your target FIRE number.

Step 3: Maximize Your Savings Rate

Your savings rate is the single biggest factor determining when you achieve FIRE:

| Savings Rate | Years to FIRE (approx.) |

|---|---|

| 20% | 37 years |

| 30% | 28 years |

| 50% | 17 years |

| 65% | 10.5 years |

| 75% | 7 years |

Singapore FIRE practitioners typically save 50-70% of income through aggressive cost optimization while maintaining quality of life.

Step 4: Build Your Investment Portfolio

Most Singapore FIRE achievers use a simple, low-cost index investing strategy:

Accumulation Phase (20s-40s): Aggressive Growth

- 80-90% Equities: Global index funds (S&P 500, MSCI World)

- 10-20% Bonds/Fixed Income: Singapore Government Securities, Money Market Funds

- CPF SA Maximization: Top up to Full Retirement Sum for guaranteed 4% returns

Approaching FIRE (5 years before): Glide Path

- Gradually shift from 90/10 to 60/40 equities/bonds

- Build cash reserves (12-24 months expenses)

- Lock in guaranteed income streams (CPF LIFE, annuities)

Early Retirement (Post-FIRE): Bucket Strategy

- Bucket 1 (Immediate): 1-2 years expenses in high-yield savings

- Bucket 2 (Short-term): 3-5 years in T-Bills, Money Market Funds

- Bucket 3 (Long-term): Remainder in growth stocks/ETFs

Step 5: Optimize with CPF & SRS

- Max out SRS contributions: $15,300/year for immediate tax relief

- Voluntary CPF top-ups: To SA (if under 55) or RA (if over 55) for guaranteed 4% returns

- CPF Investment Scheme (CPFIS): Only if you can consistently beat 2.5-4% returns after fees

- Plan for Age 55: Structure finances to maximize OA withdrawal while maintaining FRS in RA

Step 6: Monitor and Adjust

FIRE isn't "set it and forget it." Regularly review:

- Quarterly portfolio rebalancing

- Annual expense reviews (are you still on track?)

- CPF projection updates (using tools like CPF Retirement Planner)

- Market conditions and withdrawal rate adjustments

- Healthcare costs and insurance coverage

Real FIRE Success Stories from Singapore

Case Study 1: The Lean FIRE Minimalist

Profile: 42-year-old single professional, tech industry

FIRE Number: $1.2M

Time to FIRE: 12 years (started at 30)

Savings Rate: 65%

Strategy:

- Lived in paid-off 2-room HDB ($180k purchase in 2010)

- Ate 90% hawker food ($6-8 per meal)

- Cycled/MRT only, no car ownership

- Invested 100% in low-cost index funds (Syfe Equity100, StashAway)

- Annual expenses: $36,000

Result: Retired at 42, lives comfortably on $3,000/month from 3% withdrawal rate, travels budget-style 3-4 times per year, pursuing photography passion full-time.

Case Study 2: The Family FIRE

Profile: Couple with 2 children, both in finance

FIRE Number: $2.5M

Time to FIRE: 15 years

Combined Savings Rate: 55%

Strategy:

- Dual-income household ($240k combined)

- Lived in 4-room HDB despite high income

- One car only, held for 15 years

- Max SRS contributions both spouses ($30.6k/year tax savings)

- Children in public schools

- Annual expenses: $72,000

Result: Achieved FIRE at 45, now doing consulting work 2 days/week for "fun money," spend more quality time with children, annual travel budget increased to $30k.

Case Study 3: The Coast FIRE Professional

Profile: 28-year-old, saved aggressively ages 23-28

Coast Number: $350k (will grow to $1.5M by 65)

Time to Coast: 5 years

Savings Rate during accumulation: 70%

Strategy:

- Lived with parents, saved 80% of income

- Side hustles (freelance coding) earning $2k/month extra

- Invested every dollar beyond $1.5k/month personal budget

- Reached $350k by age 28

Result: Stopped aggressive saving, now works as freelance developer earning just enough for current lifestyle ($3.5k/month), travels extensively, no retirement stress knowing portfolio will compound to $1.5M by age 65 without additional contributions.

Common FIRE Myths Debunked

Myth 1: "You Have to Live in Deprivation"

Reality: FIRE is about intentional spending, not deprivation. You cut ruthlessly on things you don't value (luxury car, branded goods) to spend freely on what matters (travel, hobbies, family time). Many FIRE practitioners report higher life satisfaction because every dollar spent is deliberate.

Myth 2: "You Need a Six-Figure Salary"

Reality: FIRE is about savings rate, not absolute income. Someone earning $60k saving 60% ($36k) will reach FIRE faster than someone earning $120k saving 30% ($36k), because they only need to fund a $24k/year lifestyle vs. $84k/year.

Myth 3: "What If the Market Crashes Right When You Retire?"

Reality: This is called Sequence of Returns Risk (SORR), and it's real. Mitigation strategies:

- Use a conservative 3-3.5% SWR instead of 4%

- Maintain 2-3 years cash buffer

- Be flexible with withdrawals (cut discretionary spending during bear markets)

- CPF LIFE provides guaranteed floor regardless of market conditions

- Consider working part-time for 1-2 years if retiring into a bear market

Myth 4: "FIRE Means Never Working Again"

Reality: Most FIRE practitioners eventually do some work—but on their terms. They consult, freelance, start passion projects, or work part-time. The difference? They're no longer dependent on the income. Work becomes optional, which transforms the experience entirely.

Essential FIRE Tools & Calculators

Successful FIRE planning requires the right tools. Here are the essential calculators for Singapore:

1. FIRE Calculator

Calculate when you can achieve financial independence based on your savings rate, current portfolio, and target expenses.

2. CPF Projection Tools

Model your CPF growth, project retirement account balances, and estimate CPF LIFE payouts.

- CPF Retirement Planner (Official, Singpass required)

- Geek.sg CPF Forecast (Unofficial but highly accurate for 2023-2026 policy changes)

3. CPF Interest Calculator

Project how your CPF savings grow across OA (2.5%), SA (4%), and MA (4%) accounts with compound interest.

4. Investment Portfolio Trackers

Track your progress toward FIRE with visual tools:

- FIRE-Path Lion Budget Tracker - Visual progress tracking

- Investment Moats Spreadsheet - Comprehensive transaction tracking

5. Robo-Advisors for Automated Investing

For hands-off investing aligned with FIRE principles:

| Platform | Management Fee | Strategy | Best For |

|---|---|---|---|

| Syfe | 0.35% - 0.65% | Core, REITs, Thematic | Diversification, Cash management |

| StashAway | 0.2% - 0.8% | ERAA, Thematic | Risk-adjusted allocation |

| DBS digiPortfolio | 0.75% | Pre-set portfolios | DBS customers |

Frequently Asked Questions About FIRE in Singapore

Is FIRE really achievable in expensive Singapore?

Yes, but it requires discipline. Singapore's advantages include low taxes (max 24% vs 37% in US), strong CPF returns (2.5-4%), and subsidized healthcare. The median FIRE achiever in Singapore reaches FI in 15-20 years with a 50-60% savings rate. Key success factors: avoid lifestyle inflation, maximize CPF/SRS benefits, and choose appropriate FIRE type for your income level.

How much do I really need to FIRE in Singapore?

It depends entirely on your lifestyle:

- Lean FIRE: $1-1.5M (expenses under $40k/year)

- Traditional FIRE: $1.5-2.5M (expenses $40-80k/year)

- Chubby FIRE: $2.5-4M (expenses $80-150k/year)

- Fat FIRE: $5M+ (expenses $150k+/year)

Remember: CPF LIFE provides $720-2,060/month guaranteed income from age 65, significantly reducing your required private portfolio size.

What if I want to retire before 55 but my money is locked in CPF?

This is the "CPF Gap" challenge for early retirees. Solutions:

- Build separate taxable portfolio: Don't rely solely on CPF for early years

- SRS withdrawals: Can access from age 63 (10 years before traditional retirement)

- Barista/Coast FIRE: Work part-time to cover expenses until 55

- Rental income: Investment properties or room rental

- Calculate dual numbers: Private portfolio for ages 40-55, CPF for 55+

Should I max out CPF or invest separately?

CPF Advantages: Guaranteed 2.5-4% returns (risk-free), higher than Singapore Savings Bonds, compounds tax-free.

Separate Investment Advantages: Higher potential returns (7-10% historically), liquidity before 55, flexibility.

Recommended Strategy:

- Under 40: Prioritize taxable investments for liquidity and growth

- 40-55: Balance 50/50 between CPF SA top-ups (guaranteed 4%) and equities

- Over 55: Max RA to FRS for CPF LIFE, invest remainder in balanced portfolio

What withdrawal rate should I use? 3% or 4%?

For Singapore FIRE, most experts recommend 3-3.5% SWR due to:

- Longer retirement horizon (40-50 years vs Western 30 years)

- Higher medical inflation (16.9% vs general 2-3%)

- Conservative risk management in Asia

Advanced Strategy: Use variable SWRs:

- 3.0-3.25% for essentials (food, housing, healthcare)

- 3.5-4.0% for expenses with fixed timeline (mortgage ending in 20 years)

- 5.0%+ for flexible wants (travel, hobbies) that can be cut during downturns

Can PRs achieve FIRE in Singapore?

Yes, with some considerations:

Advantages: Access to CPF (same benefits as citizens for retirement), ability to purchase resale HDB flats, Singapore tax benefits.

Challenges: PR status not guaranteed long-term, different grant eligibility, potential need to maintain home country retirement accounts.

Strategy: Build portable wealth (global index funds, SRS, cash), maintain flexibility to retire in Singapore or home country.

How do I handle healthcare costs in early retirement?

Healthcare is the #1 risk for early retirees. Essential strategies:

- Integrated Shield Plans: Buy comprehensive coverage while employed and healthy

- MediSave Maximization: Ensure BHS is hit ($79k for 2026) for overflow to RA

- Buffer 20-30%: Add extra to FIRE number specifically for medical inflation

- Preventive Health: Invest in fitness, nutrition, stress management now

- Geographic Arbitrage: Some opt for medical tourism to Thailand/Malaysia for non-urgent procedures

What if I get bored in retirement?

This is why many prefer "Financial Independence" over "Retire Early." FIRE gives you options:

- Pursue passion projects without income pressure

- Start a business you've always dreamed of

- Volunteer for causes you care about

- Learn new skills (languages, instruments, arts)

- Consulting/freelancing on your terms

- Extended travel and cultural immersion

Most FIRE achievers report being busier after retirement—just doing things they actually enjoy.

What about kids? Can I FIRE with a family?

Yes, but it requires higher numbers and longer timelines. Singapore family FIRE considerations:

- Education: Public schools significantly cheaper than international schools (factor $2-5k vs $30k+ annually)

- Enrichment: Budget $500-1,500/month/child for tuition, activities

- Healthcare: Family Shield plans add $300-800/month

- Housing: 4-5 room HDB or condo needed (affects FIRE number)

- Allowances: Teen years increase expenses

Realistic family FIRE number in Singapore: $2.5-3.5M for comfortable lifestyle with 2 children through university.

Should I pay off my HDB mortgage or invest?

This depends on your loan rate vs investment returns:

HDB Loan (2.6%): If you can earn >2.6% after-tax returns consistently, invest instead. CPF SA already gives you 4%, so it's mathematically better to invest excess cash in equities and use CPF for HDB payments.

Bank Loan (1.5-1.8% currently): Definitely invest rather than prepay. Even conservative investments beat these rates.

Psychological Factor: Some people sleep better with a paid-off home regardless of math. If mortgage-free living reduces stress significantly, factor that non-financial benefit into your decision.

How do I explain FIRE to family who think I'm crazy?

Common objections and responses:

"You're too young to retire!"

Response: "I'm not retiring from life, just from mandatory employment. I'll pursue passions, volunteer, maybe even work on projects I love—just not for survival."

"What about inflation? Your money will run out!"

Response: Show them the math. Historical data supports 3-4% SWR for 30+ years. Your portfolio continues growing even in retirement. Plus CPF LIFE provides guaranteed floor from age 65.

"You'll be bored!"

Response: "I have a list of 20+ things I want to learn, places to explore, and projects to build. I'm bored NOW working 60-hour weeks on someone else's dreams."

Often, showing your detailed spreadsheet, conservative assumptions, and backup plans helps skeptical family members see you're being responsible, not reckless.

Take Your First Step Toward FIRE Today

Financial Independence isn't a distant dream—it's a achievable goal with the right plan, discipline, and tools. Whether you're aiming for Lean FIRE in 10 years or building toward a comfortable Traditional FIRE over 20 years, the journey starts with a single step.

Your Next Actions:

- Calculate your FIRE number using our FIRE Calculator

- Track your expenses for 3 months to establish your baseline

- Set a savings rate target (start with 30%, work up to 50%+)

- Maximize CPF & SRS contributions for tax-efficient growth

- Build your investment portfolio with low-cost index funds

- Monitor quarterly and adjust as needed

Remember: The best time to start was 10 years ago. The second best time is today.

Have questions about your unique FIRE situation? Ask Rich, our AI financial assistant, for personalized guidance on achieving financial independence in Singapore.

References & Further Reading

This guide is based on research from authoritative sources and the Singapore FIRE community:

Core FIRE Principles

- Safe withdrawal rate research: Saxo Bank - Safe Withdrawal Rate Guide

- The 4% rule limitations: Business Times - Why the 4% Rule May Not Be the Answer

- Trinity Study foundation: Wikipedia - Trinity Study

- FIRE calculator methodology: Lightyear FIRE Calculator

Singapore-Specific FIRE

- FIRE achievability in Singapore: Syfe - Is It Really Possible to FIRE in Singapore?

- Singapore retirement costs: Syfe - How Much Do You Need to Retire in Singapore?

- FIRE success stories: The Simple Sum - Retiring Young: A Singaporean on FIRE

- FIRE movement Singapore: Standard Chartered - Get FIRED Up

- Singapore FIRE guide: Saxo Bank - FIRE Guide for Singapore

CPF & Official Tools

- CPF Retirement Planner (Official): CPF Board Retirement Planner

- CPF LIFE integration: DBS - Combining 4% Rule with CPF LIFE

- CPF forecast calculator: Geek.sg CPF Forecast Tool

- Are CPF savings enough?: GrowBeansprout - CPF Retirement Planning

SRS & Tax Optimization

- SRS calculator: StashAway SRS Calculator

- SRS tax treatment: IRAS - Tax on SRS Withdrawals

- SRS strategy guide: DBS - Supplementary Retirement Scheme

HDB & Housing

- Lease Buyback Scheme: HDB Official - Lease Buyback Scheme

- LBS explained: The Financial Coconut - HDB Lease Buyback Scheme

- HDB in FIRE calculations: r/singaporefi - HDB in FIRE Planning

Healthcare & Inflation

- Medical inflation Singapore 2026: WTW - Medical Cost Projections 2026

- Singapore healthcare costs: Insurance Asia - Rising Medical Costs

- MAS inflation framework: MAS Monetary Policy FAQs

Investment & Portfolio Tools

- Syfe robo-advisor: MoneySmart - Syfe Review

- Syfe Equity100 strategy: Syfe Equity100 Portfolio

- Singapore T-Bills guide: Syfe - Complete Guide to T-Bills

- Money Market Funds: StashAway - MMF Guide 2026

- Portfolio tracking tools: Seedly - Best Portfolio Tracking Apps

Community Resources

- FIRE-Path Lion blog: FIRE-Path Lion - Pursuing FI in Singapore

- Visual FIRE tracker: FIRE Budget Tracking Spreadsheet

- Reddit Singapore FI: r/singaporefi Community

- Singapore FIRE discussions: FIRE Types Discussion

Related Calculators

- FIRE Calculator - Calculate when you can achieve financial independence

- CPF Interest Calculator - Project your CPF account growth

- CPF Contribution Calculator - Understand your monthly CPF contributions

- HDB Loan Calculator - Calculate your housing affordability

Disclaimer: This guide is for educational purposes only and does not constitute financial advice. FIRE strategies involve significant risk, including the possibility of running out of money. Historical returns do not guarantee future performance. Medical inflation, market volatility, and personal circumstances can dramatically impact outcomes. The 4% rule and other withdrawal strategies have limitations and may not apply to all situations. Always consult a licensed financial advisor before making major financial decisions. Information accurate as of February 2026 but subject to change as policies and market conditions evolve.